China's cancellation of aluminum export tax rebates has shaken the global aluminum industry. China's aluminum production accounts for 60% of the world's total, and its exports account for 35%. The aluminum industry chain consumes a huge amount of electricity. Chinese aluminum products occupy an important position in the global market, and the United States is China's largest buyer. China's tightening of aluminum exports will prompt the world to reassess China's industrial capacity.

The Ministry of Finance and the State Administration of Taxation issued an announcement that from December 1 this year, the export tax rebate for aluminum and other products will be cancelled. The aluminum products involved almost cover major aluminum profiles, aluminum sheets, strips and foils, aluminum bars and other aluminum products.

So far, my country is the undisputed absolute overlord of the global aluminum industry. In 2023, China's aluminum exports reached 5.287 million tons, accounting for about 35% of the total global trade.

In terms of production, China's absolute advantage is even more terrifying, with primary aluminum production accounting for 59% of the world, aluminum production accounting for about 66%, electrolytic aluminum accounting for 60%, and smelting aluminum accounting for nearly 60%.

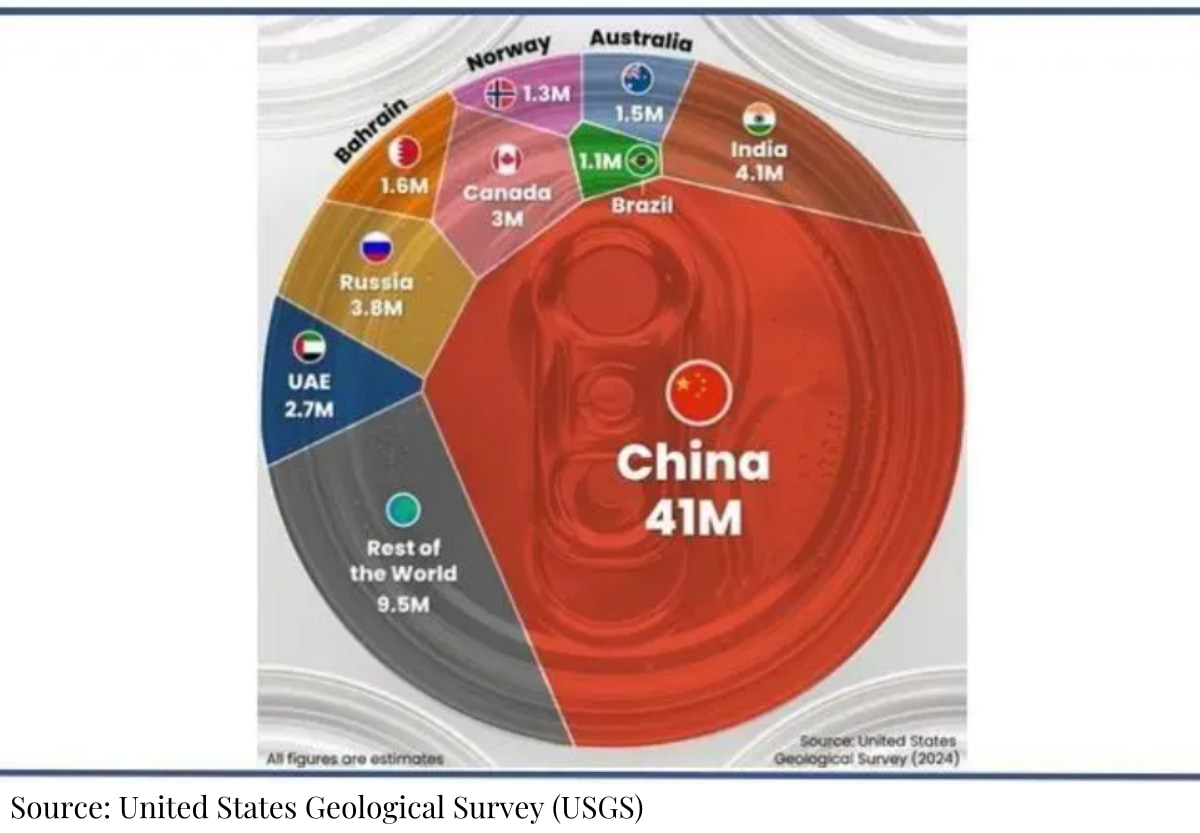

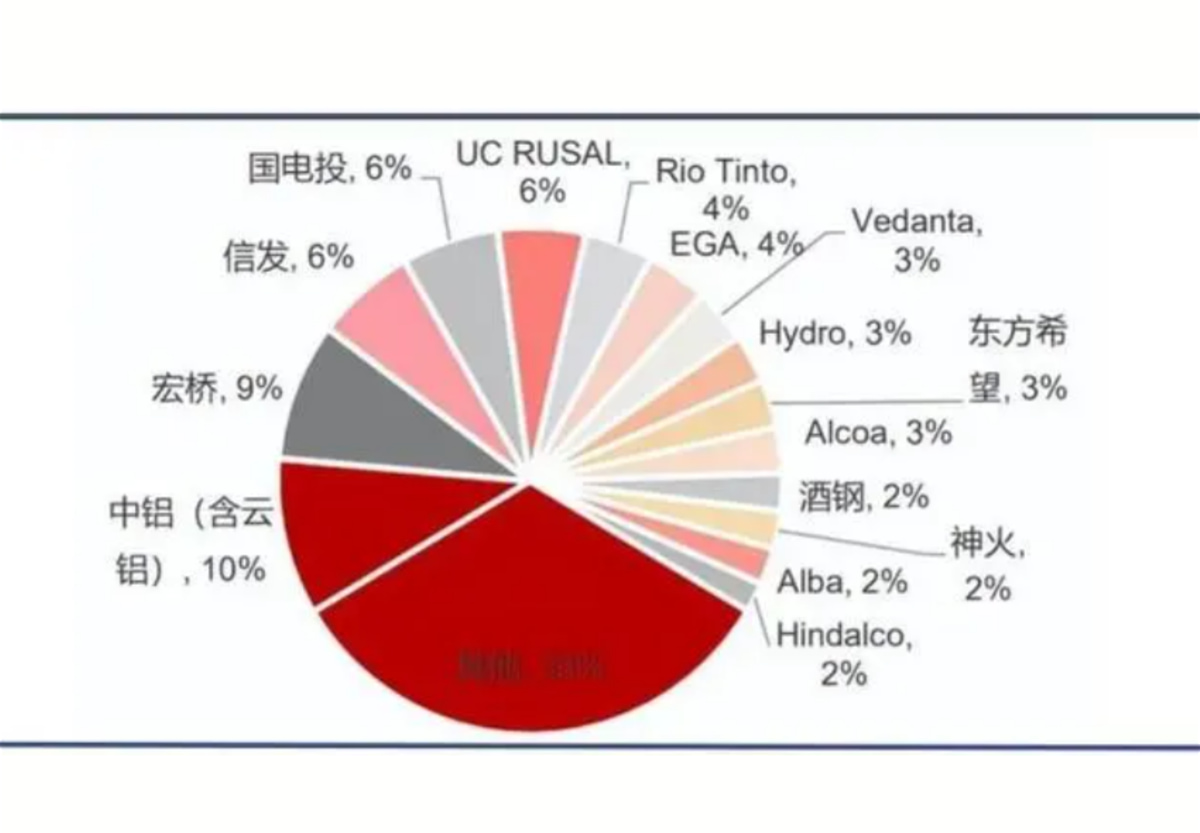

Global Aluminum Smelting Landscape

According to statistics from the United States Geological Survey (USGS), China's smelting aluminum output in 2023 will be ten times that of the second-ranked India, and the total output of other countries in the world is only 70% of that of China.

As an extremely important basic resource, aluminum products play a key role in the construction, rail transit, automobile, cable and other industries. Due to the super status of Chinese aluminum products in the world pattern, countries around the world can hardly bypass China when using aluminum products.

Even though various trade measures such as anti-dumping duties, countervailing duties and tariffs have been implemented against my country in recent years, the United States is still the world's largest buyer of Chinese aluminum products and the world's largest importer of aluminum materials.

The aluminum industry chain, especially electrolytic aluminum, is a "power-eating behemoth" with a huge appetite, which seriously restricts the development of the aluminum industry in other countries and regions. Based on the export volume of aluminum materials in my country last year, at least 740GW of electricity was consumed. By the end of September this year, the total installed capacity of photovoltaic power in my country has reached this figure.

Due to geopolitical conflicts and the pursuit of reducing carbon emissions by mainstream countries around the world, the power supply is insufficient, the energy crisis has emerged, and the power left for electrolytic aluminum will only decrease. China's reduction in aluminum exports will mean a large number of chain reactions for countries around the world, and a subsequent reassessment of China's industrial capabilities.

Due to the great difficulty of refining, aluminum was a very rare metal more than a hundred years ago. In order to show his lofty status, Napoleon III specially made an aluminum crown, and only he could use exclusive aluminum tableware, while others could only use gold or silver tableware.

Aluminum itself is the most abundant metal element in the earth's crust. It was not until 1889 that Austrian scientist Bayer invented a method of extracting alumina from bauxite, and then invented the electrolytic production method, which officially opened the prelude to the large-scale industrialization of aluminum. At present, almost all aluminum companies in the world use the "Bayer method".

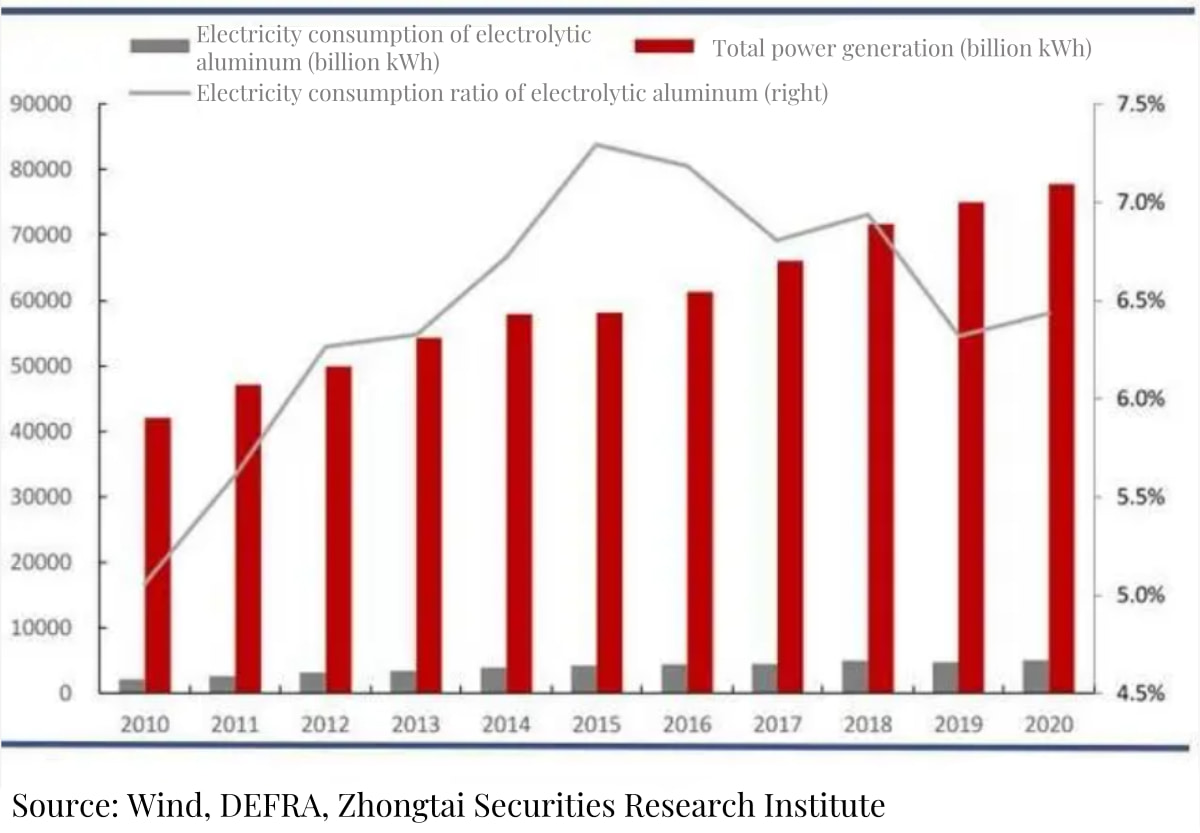

The efficiency of aluminum smelting has been greatly improved, but the defect of electrolytic aluminum is that it consumes huge electricity, which can be called a "power-swallowing monster". It takes 13,600 kw/h direct current (nearly 14,000 degrees) to smelt 1 ton of electrolytic aluminum. Once upon a time, my country had to use more than 7% of its electricity to produce electrolytic aluminum a year, and this was only one link of electrolytic aluminum. The power consumption of the entire industrial chain would be a super huge number.

The proportion of electricity consumption of electrolytic aluminum in my country to the national electricity consumption

In 2023, the national electrolytic aluminum output will be 41.513 million tons. Based on this calculation, the power consumption will be as high as 564.6 billion kWh, equivalent to 5646GW. Last year, the aluminum export volume was 5.287 million tons, and the power consumption was close to 740GW.

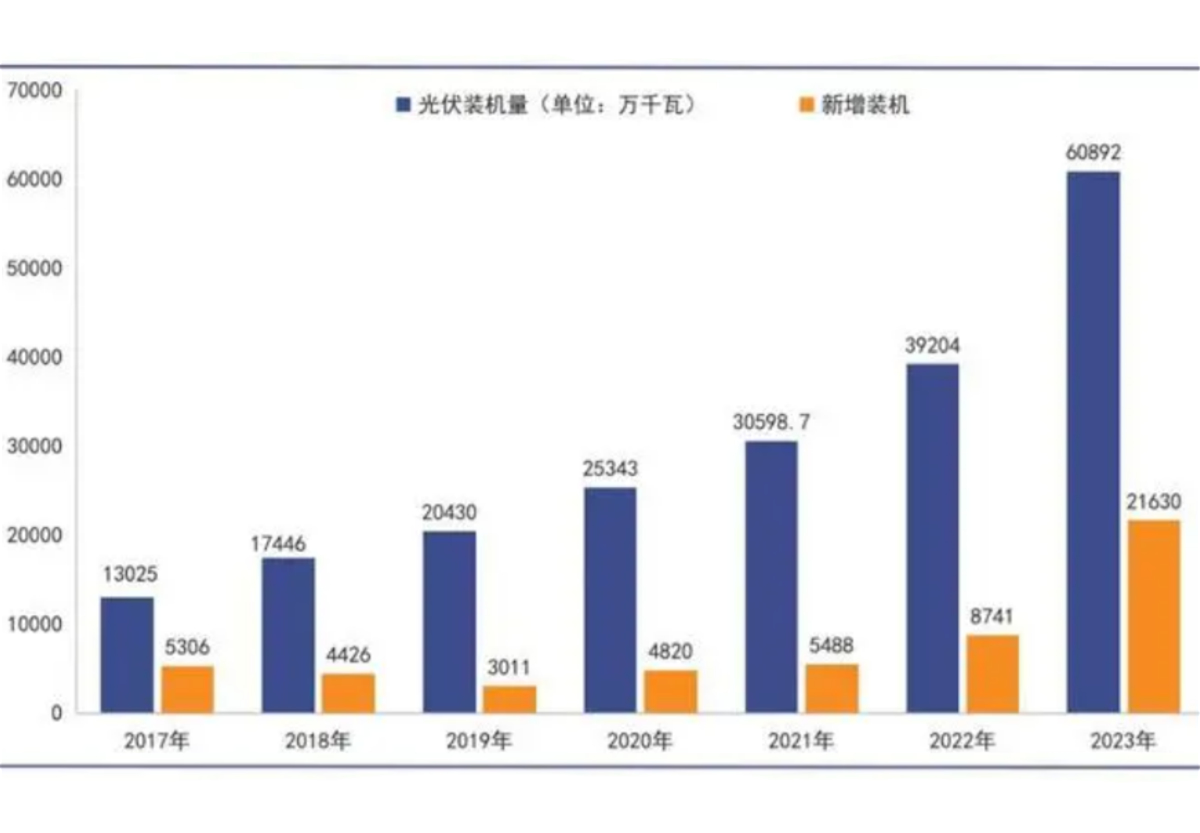

You should know that at the end of last year, my country's cumulative photovoltaic power generation installed capacity was less than 610GW, and the global cumulative capacity was 1546GW. By June this year, my country's photovoltaic power generation accumulated 713.5GW, and by the end of September, it reached 770GW, which means that China's aluminum exports alone require all of China's photovoltaic power generation to power it.

Statistics on China's photovoltaic power generation installed capacity from 2017 to 2023

At the end of last year, Europe's cumulative photovoltaic installed capacity climbed to 263GW, the United States 162GW, and India just exceeded 60GW. Relying solely on clean energy such as photovoltaics, the gap is huge.

Electrolytic aluminum is also a high-emission industry. The carbon emissions during the smelting process once accounted for about 5% of my country's total carbon emissions, second only to steel and cement. Such a huge carbon emission is unbearable for any country pursuing a green energy transformation.

In November 2018, the European Union proposed to achieve carbon neutrality by 2050. Since then, it has further established the goal of reducing emissions by 55% by 2030 (compared with 1990) for each member country; the United States plans to reduce greenhouse gas emissions to half of 2005 by 2030 and achieve "net zero" emissions by 2050.

Of course, this goal may become repeated due to the new government taking office. For this reason, as the world's second largest aluminum producer, India has become the world's third largest carbon emitter after China and the United States. In order to achieve 500GW of clean energy by 2030, India is frantically launching photovoltaic projects. In the first half of 2024, its new photovoltaic installed capacity was 14.9GW, a year-on-year increase of 282%, setting a record high for the same period in history.

And my country is the world's largest photovoltaic country, with an absolute advantage in the complete industrial chain. 80% of India's photovoltaic modules rely on Chinese manufacturing. As a last resort, it is reported that even India's second largest aluminum group, Hindalco, has begun planning to enter the field of solar modules. At the end of last year, the company also planned to invest 8 billion rupees to build another battery foil manufacturing plant.

Therefore, my country's announcement to tighten aluminum exports has shocked the world and will pay more attention to China's industrial production capacity, whether it is traditional industrial products or new energy products such as photovoltaics and wind power.

Based on its huge scale advantage, Chinese aluminum products have conquered the world. Especially the United States, even though it has introduced various trade restrictions, it is still the largest buyer of Chinese aluminum products.

As early as 2018, the United States launched a 301 tariff review on China, involving 33 sub-items of aluminum products; in October 2023, the U.S. Department of Commerce announced a preliminary anti-dumping duty of 167.16% on ordinary aluminum alloy plates from China, an anti-dumping duty of 59.31% on Chinese aluminum profiles, and the highest anti-subsidy rate on Chinese companies involved in the case reached 137.65%;

On September 13 this year, the United States decided to increase the tariff rate on my country's exports of electric vehicle batteries, key minerals, steel, aluminum, masks and other products to 25%.

With the successive tax increases, almost all aluminum products are covered. It can be said that the United States has launched an all-round and indiscriminate "comprehensive attack" on Chinese aluminum products. However, due to the extreme dependence of the United States on aluminum imports, by 2023, the United States will still be my country's largest aluminum product export market, with a total export volume of 694,000 tons and an export value of US$3.79 billion.

Due to the continued increase in demand for industries such as lightweight automobiles and rail transit, Goldman Sachs expects that there will be a gap of 7.24 million tons in the global aluminum market this year.

However, due to the constraints of the zero-carbon emission target, my country's electrolytic aluminum has approached the ceiling of compliant production capacity. Some securities firms have calculated that the limit of compliant production capacity of electrolytic aluminum is 44.67 million tons, and there is not much room for expansion.

According to the regulations of the previous special action of various departments to clean up and rectify violations of electrolytic aluminum laws and regulations, all projects involving electrolytic processes must implement electrolytic aluminum capacity replacement, that is, "construction of electrolytic cells must be replaced."

Looking overseas, after Russia played the "gas cut" king bomb, Norwegian Hydro decided to close the Slovak aluminum smelter, German large aluminum rolling company Speira announced a reduction of half of its German smelter's production capacity, and France's Dunkirk Aluminum, the largest aluminum smelter in Europe, also said it would reduce production by 22%.

According to incomplete statistics, overseas production capacity to be closed in 2022-2023 will reach 1.581 million tons. Combined with the impact of the dual carbon policy and energy issues, there is a high possibility of further production cuts.

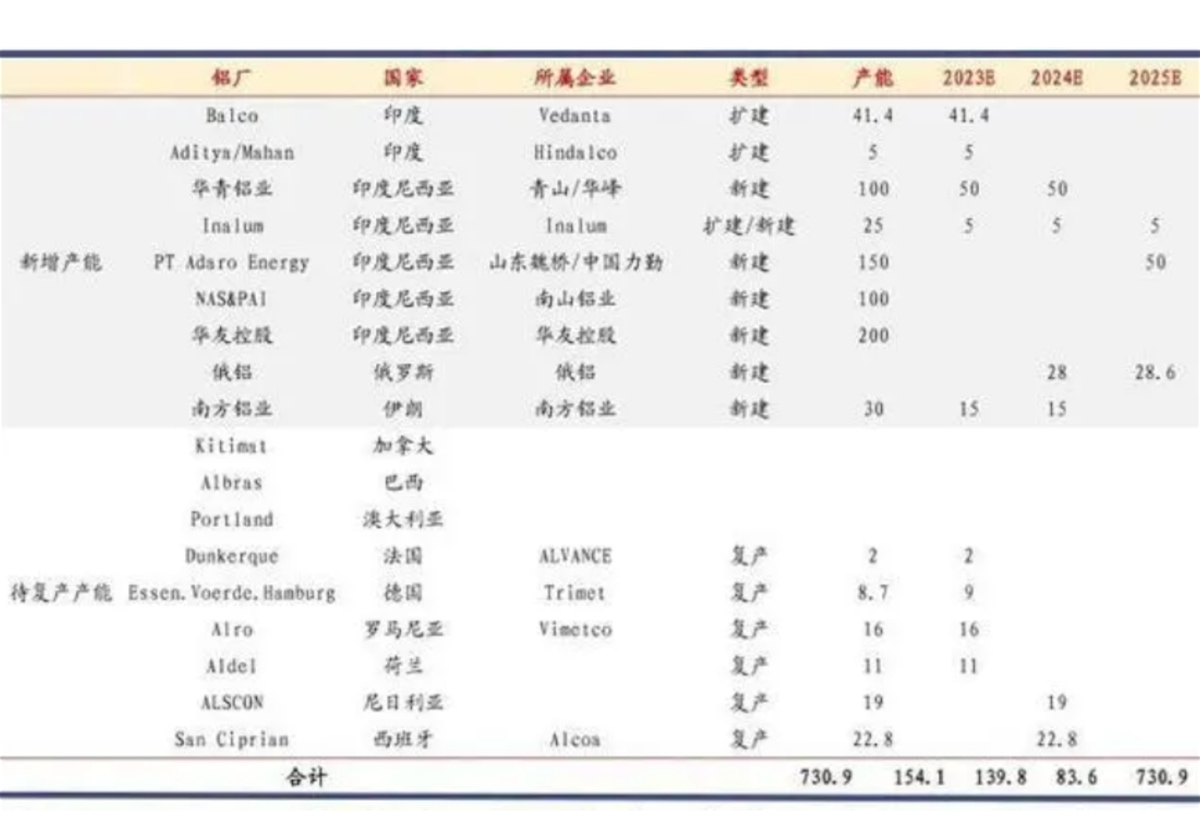

Overseas asset resumption of production from 2023 to 2025 (10,000 tons)

In fact, the main force of new overseas production capacity is still Chinese companies. Huaqing Aluminum, Huayou Holdings, Nanshan Aluminum, Shandong Weiqiao/China Liqin and other companies have invested and built a production capacity of up to 6.05 million tons, while aluminum companies in other countries have only added 714,000 tons of new capacity and are facing many uncertainties.

In order to bypass trade sanctions from Europe and the United States and other countries, my country's aluminum companies have also accelerated their overseas production, especially in Indonesia, where multiple projects have been implemented. Coupled with the rebound in aluminum prices, domestic aluminum companies have achieved remarkable results. Nanshan Aluminum achieved a net profit of 3.49 billion yuan in the first three quarters, a year-on-year increase of 62.94%; Chalco made a huge profit of 9.017 billion yuan in the first three quarters, a year-on-year increase of 68.46%; China Hongqiao made a huge profit of 9.155 billion yuan in the first half of the year, a year-on-year increase of 2.7 times.

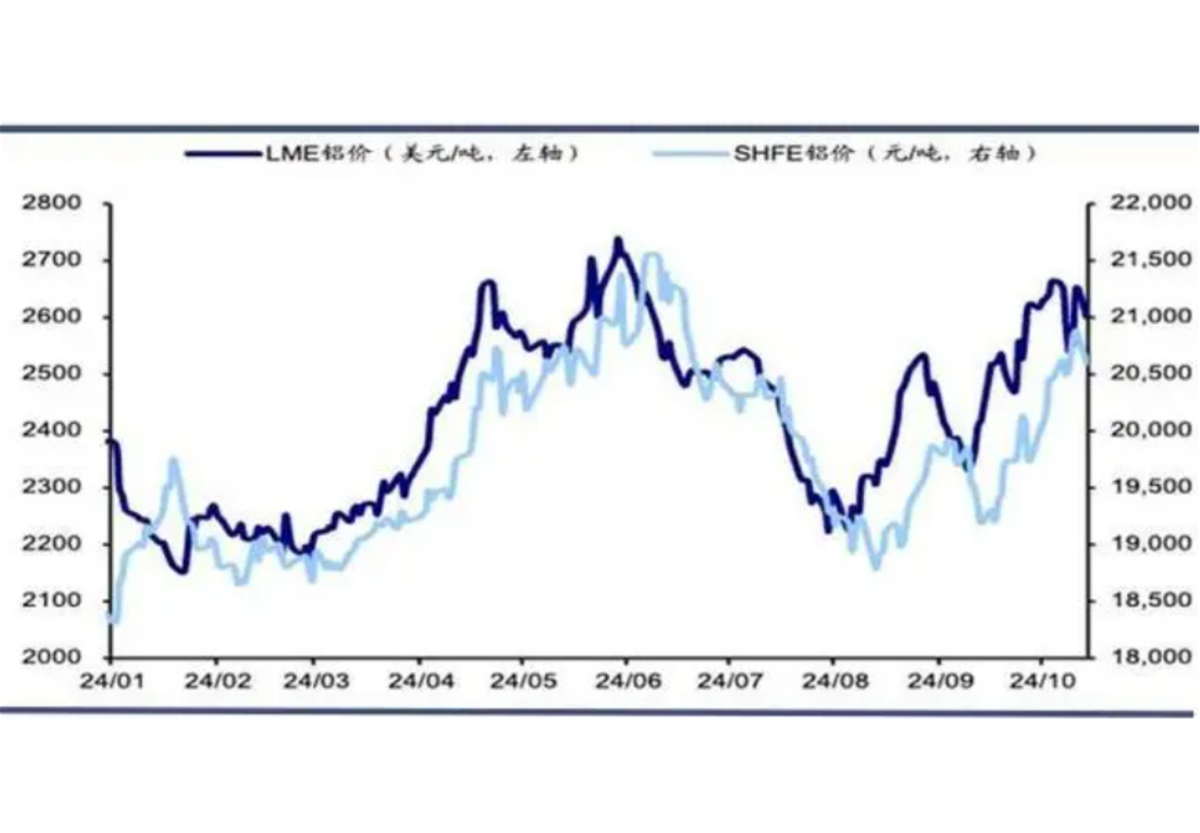

LME and SHFE aluminum price trends

At present, China alone occupies seven seats in the world's top 15 electrolytic aluminum producers, namely Chinalco, Hongqiao, Xinfa, State Power Investment, East Hope, Jiugang and Shenhuo, with an output accounting for 37% of the global total.

Due to the soaring costs of various factors such as energy, Alcoa has continued to lose money since 2022. It has also permanently closed the Intalco aluminum smelter in Washington State, and its output has withdrawn from the top ten in the world.

The crisis of aluminum companies in the United States and Europe indicates that the United States' dependence on Chinese aluminum products will further deepen.

The huge scale of the aluminum products industry allows China to hold sufficient trade chips, with one hand allying with southern countries and the other hand exporting to developed countries.

China's aluminum manufacturing capacity leads the world, but upstream resources are heavily dependent on overseas imports. my country's bauxite and alumina reserves account for only 2% of the world's total. Currently, about 70% of bauxite needs to be imported.

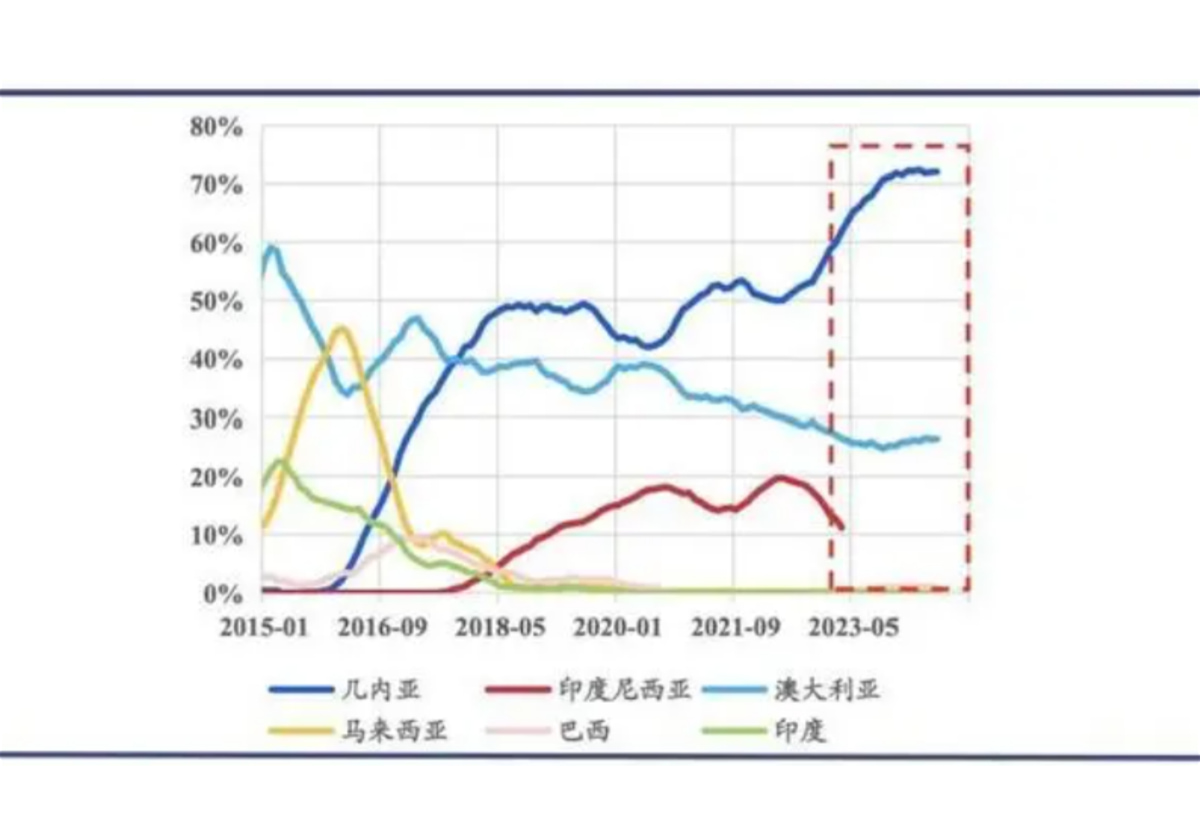

From the second half of 2023, China's bauxite imports will mainly come from Guinea

The world's bauxite is concentrated in Guinea, Vietnam, Australia, Brazil, Indonesia and other countries, accounting for 65% of the world's reserves. Guinea is especially famous for its high-grade and large-scale bauxite resources. It is the main source of global bauxite in recent years and the largest source of minerals in my country.

In October this year, Chinalco's mining volume in Guinea hit a record high for a single month, and the amount of ore shipped back to China hit the best level in the same period in history; Tianshan Aluminum recently stated that the company's bauxite project in Guinea has entered the production and mining stage and will soon be sent to China, which will greatly reduce the cost of bauxite raw materials in the future.

Judging from the distribution of the source countries of my country's imported bauxite in recent years, my country's dependence on Guinea has increased rapidly. In the first nine months of this year, 74.5% of the bauxite came from Guinea, and the dependence on Australia has been significantly reduced.

Another core country is Indonesia. In June 2023, Indonesia issued a bauxite export ban policy, requiring local resources to be tied to local alumina production capacity, landing projects in the country, creating more jobs and national income. Therefore, my country's aluminum companies have directly set up factories in Indonesia to obtain the cost dividends brought by local low-priced bauxite.

Jinjiang Group has planned 6 million tons of alumina production capacity in Indonesia in 5 phases, and the first phase of 1 million tons has been put into construction in April this year; Tianshan Aluminum, the world's second largest alumina producer, has a 2 million tons alumina project listed as an Indonesian national strategic project; Nanshan Aluminum is also promoting a 2 million tons alumina expansion project and a 250,000 tons electrolytic aluminum project; Shandong Innovation Group also plans to build a 2 million tons alumina project in Indonesia.

Concentration of electrolytic aluminum enterprises (2022)

Driven by Chinese enterprises, advanced smelting technology and complete industrial chains have entered Indonesia, forming a development pattern in which upstream bauxite, alumina and electrolytic aluminum are produced in Indonesia, and the domestic focus is on high-barrier, high-value-added products such as aviation plates and automobile plates.

With the help of Made in China, it is roughly estimated that Indonesia's alumina production capacity may exceed 50 million tons this year, and is expected to increase to 80 million tons by 2026, becoming a major alumina producer in the world, and a strategic rear for China's mid- and downstream aluminum products.

At present, the economic development of countries around the world is extremely unbalanced. Many southern countries have rich upstream resources, but lack mining, smelting and processing technology and market capacity. China combines manufacturing capabilities, advanced technologies with the resources of southern countries for mutual benefit and win-win results; on the other hand, it relies on its overwhelming supply advantage to force developed countries to purchase.

The global aluminum industry pattern is the best embodiment of this model. China is the only country in the world that has all kinds of industries. Complete, prosperous and powerful are the distinctive labels of Chinese industrial manufacturing that resound throughout the world.

Compared with comprehensiveness and completeness, people generally overlook that it is the huge scale advantage that allows China's industrial products, including primary industrial products such as electrolytic aluminum, to have sufficient advantages in price relative to global competitors. At a time when Europe and the United States have erected trade barriers against China, the value brought by scale is the killer of China's products that continue to expand globally.

Based on the huge scale of manufacturing, China can, on the one hand, unite and cooperate with developing countries to purchase resources; on the other hand, it can manufacture high-level and cost-effective industrial products for global marketing. On the energy side, it has formed the advantages of the entire clean energy industry chain such as photovoltaics and wind power, leading the global industrial civilization forward, and also raising the barriers to industrial production from the side.

Even in the global energy low-carbon transformation, other countries have to buy Chinese new energy products.

It is no exaggeration to say that in the context of intensified global economic turmoil, no country dares not to think about the consequences of China's restrictions on the export of certain industrial products. Starting with various rare earth and aluminum products, the world will have a clearer understanding of this.

Whatsapp : +8617366266559

Email : sales@sunmayalu.com

Tel : +86 -17366266559

Hi! Click one of our members below to chat on